As an employer or manager, it’s important to understand the difference between “double time” vs “overtime”. You should also know how to calculate them properly. Both terms refer to additional pay that employees receive for working beyond their regular working hours.

However, they differ in how much extra pay an employee will receive for their extra hours. These rules and regulations around double time and overtime are typically derived from the fair labor standards act (FLSA).

In this blog post, we will explore the differences between double time and overtime, and how to calculate them. We will also discuss how automated Employee Scheduling Software, like Celayix, can simplify the process for employers.

Double Time vs. Overtime: What’s the Difference?

Overtime refers to the additional pay that employees receive for working beyond their regular working hours. Typically, employees are entitled to receive overtime pay at a rate of 1.5 times their regular rate of pay for any hours over their contracted amount. For example, if an employee’s regular hourly rate is $15 per hour, their overtime rate would be $22.50 per hour. If a worker is contracted for 35 hours, and they work 40 hours, they will receive an overtime rate of $22.50 for those 5 additional hours.

On the other hand, double time refers to the additional pay that employees receive for working beyond a certain threshold of hours in a day or week. The double time rate is usually twice the employee’s regular hourly rate. For example, if an employee’s regular hourly rate is $15 per hour, their double time rate would be $30 per hour. If a worker is scheduled for 12 hours in a shift, but they work 13 hours, they may receive the double time rate for the extra hour.

The threshold for double time can vary depending on the employer, industry, and location. More often than not, it is used to thank employees for working obscure, or unusual hours. In some industries, it’s common for employees to receive double time for working Sundays, or public holidays.

It’s also worth noting that these rules apply to hourly workers. A lot of the time salaried workers work overtime, or obscure hours in an unpaid capacity. This is because workers earning more than $35,568, you’re exempt from earning overtime in general.

What happens if an employee works hours that qualify for both overtime and double-time?

When an employee works hours that qualify for both overtime and double-time, the double-time rate usually applies. Employment laws and company policies dictate how these situations are handled. However, the general principle is that employees should not be compensated twice (i.e., both overtime and double-time for the same hours).

Calculating Overtime

Calculating overtime is relatively straightforward. To calculate an employee’s overtime pay, you need to determine their regular hourly rate. Then, you multiply it by one and a half. Then, you need to multiply that amount by the number of overtime hours worked.

Here’s an example:

Let’s say an employee’s regular hourly rate is $15 per hour and they worked 10 hours of overtime. To calculate their overtime pay, you would:

$15 (regular hourly rate) x 1.5 (overtime rate) = $22.50 (hourly overtime rate) $22.50 (hourly overtime rate) x 10 (overtime hours worked) = $225 (total overtime pay)

Calculating Double Time

Calculating double time is different to calculating overtime. To calculate an employee’s double time pay, you need to determine their regular hourly rate and multiply it by two. Then, you need to multiply that amount by the number of double time hours worked.

Here’s an example:

Let’s say an employee’s regular hourly rate is $15 per hour and they worked 5 hours of double time. To calculate their double time pay, you would:

$15 (regular hourly rate) x 2 (double time rate) = $30 (hourly double time rate) $30 (hourly double time rate) x 5 (double time hours worked) = $150 (total double time pay)

The Impact of Overtime and Double Time

As you can imagine, relying on both double time and overtime is a costly way to run your business. There is a clear financial impact. If employees often work overtime or double time, your payroll costs will rise quickly.

Aside from that, employees tend to burn out rather quickly when they regularly work overtime. Employee burnout leads to an array of other workforce management issues including absenteeism, disengagement, and potentially turnover.

On the other hand, you may have employees who rely on the income from overtime or double time to supplement their regular hourly rates. So, when it comes to managing overtime effectively, you need to move carefully and keep conversations open and honest.

Overtime vs. Double Time – Automating the Process with Celayix

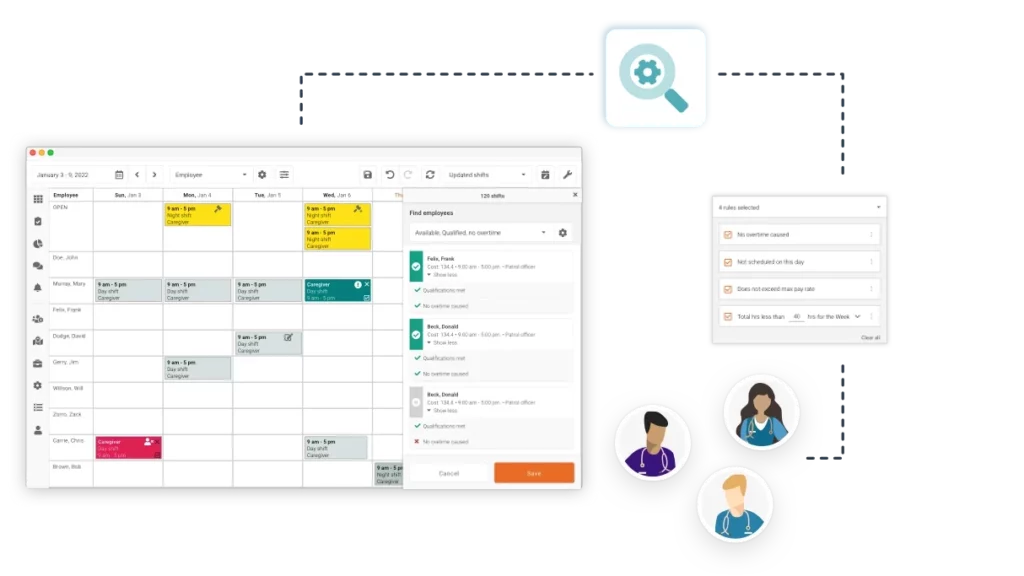

Calculating overtime vs double time can be a tedious and time-consuming process, especially for larger organizations with many employees. If a business is using manual employee scheduling methods, it can lead to errors in payroll. That’s where automated employee scheduling software like Celayix can help.

Celayix’s automated time and attendance tracking feature can accurately track employee hours, including overtime and double time. This feature can calculate an employee’s overtime and double time pay based on their regular hourly rate and the number of hours worked beyond the regular working hours or the threshold for double time.

Using Celayix can save employers time and reduce the risk of errors in payroll calculations. Employers can also use our software to create custom business rules for calculating overtime and double time, based on their specific business needs. Understanding the difference between double time and overtime, and how to calculate them properly, is important for both employers and managers. By using Celayix’s automated time and attendance tracking feature, employers can accurately track employee hours and calculate their overtime and double time pay.

How else can Celayix help?

In addition to payroll calculations, Celayix also offers a range of other features to help employers effectivley manage their workforce. These include shift scheduling, time-off requests, and employee communication tools. With its customizable features and easy-to-use interface, Celayix is a powerful tool for businesses of all sizes looking to streamline their employee scheduling and management processes.

It’s crucial for employers to take the time to understand the difference between double time and overtime and how to calculate them properly. By using automated employee scheduling software like Celayix, employers can simplify the process and ensure accurate payroll calculations, freeing up time to focus on other important aspects of their business. If you’d like to learn more about how to streamline payroll with Celayix, get in touch today to schedule a free, custom demo.