For a long time, tip management for servers and other tipped employees has been an area of contention. After a long battle, the Department of Labor introduced the “Final Rule” around the issue. This rule changes the legal landscape by empowering tipped employees to keep more of their hard-earned tips.

The DOL published the long-awaited “final rule” on September 24. The laws came into effect on November 23, 2021. Before we look at the implications for businesses and employees, let’s look at the current minimum wage laws for the hospitality industry.

Minimum Wage Laws

Minimum wage laws in the U.S. mean that servers generally rely on tips for most of their income. Under the Fair Labor Standards Act, employers in the restaurant and hospitality industries can take a tip credit against employees’ wages.

This means that the employer may pay tipped employees less than minimum wage if their tips cover the difference. Currently, the federal minimum wage for non-exempt employees is $7.25 per hour. This is already pretty low before you consider tip management practices.

Under the FLSA, employers must pay the “minimum cash wage’ at least, which is currently $2.13 per hour. While this may seem shocking, we assure you that paying tipped employees $2.13 per hour is entirely legal. Employers are not breaking any laws as long as their tips bring them up to or over the minimum wage.

Before the recent changes to the law in November of 2021, the U.S. generally did not standardize tip management. Therefore, tipped employees had no guaranteed rights to keep all their earned tips.

What is the 80/20 rule?

Since 2022, various companies have been grappling with the need to better track time allocations, particularly in the restaurant industry, as the Department of Labor (DOL) reintroduced the “80/20” tip credit rule under President Biden.

The rule, which took effect on December 28, 2021, has undergone changes to address disputes related to defining tip-producing and tip-supporting work. The revised rule stipulates that employees must spend a minimum of 80% of their time on tip-producing work and 20% on tip-supporting work, with a notable addition of a 30-minute limit for consecutive non-tipped work.

Is it a law?

Although not a law, the rule carries the force of law, presenting challenges for restaurant owners who must adapt their timekeeping processes and record-keeping systems to comply. The 30-minute rule aims to protect tipped workers and requires employers to carefully manage employee schedules and internal policies to avoid potential legal challenges.

Despite the potential record-keeping challenges, the rule offers additional income for tipped staff during a challenging period for hiring and retention in the restaurant industry.

Tip Pools in Tip Management

A common tip management practice in most restaurants and hospitality organizations is using tip pools. Tip pools originated from federal laws. Generally, the practice involves tipped employees putting their tips into a collective pool.

Tipped employees then split the tip pool with non-tipped employees. Essentially, when you tip your server at a restaurant, their non-tipped colleagues, such as hosts, chefs, or dishwashers, benefit too. Considering how these employees contribute to the customer experience, you can see how tip pooling makes sense.

Tip pooling has specific rules and regulations from the government on how establishments should handle it. This is to make sure it’s fair for the employees. Until the new laws came into place, the FSLA allowed employers to use tip pools as long as they paid their employees at least the minimum wage of $7.25 per hour and did not take a tip credit.

Therefore, employers who choose to take a tip credit and don’t pay minimum wage can’t legally implement a tip pool.

Tip Management for managers and supervisors

Previously, there were laws that prohibited managers and supervisors from receiving employees’ tips by participating in a tip pool. It also prohibited this practice in any other way, regardless of whether they take a tip credit or not. This is to protect lower-paid employees, who would not be required to share tips with management.

The new Final Rule provides welcome guidance on tip management specifically for managers and supervisors. It breaks down when they can keep tips and when they should share them with other non-management employees. Under the Final Rule, they are permitted to keep tips they receive for services provided “directly and solely” by them.

For example, supervisors often work shifts as bartenders or servers. Now, they can legally keep the tips they earn for those shifts. However, if they assist servers/bartenders, they cannot receive any of the tips given to the server.

Another update to tip management under the Final Rule allows managers and supervisors to share their tips with non-management employees. Essentially, they are now permitted to contribute to tip pools.

Although tip management guidelines and tip pooling requirements are now more explicit under the Final Rule, employers must still be diligent. They must pay attention to state laws that apply to them, which may differ from federal regulations. In fact, some states specifically ban tip sharing between tipped and non-tipped employees. If, as an employer, you are ever in doubt about tip management and conflicting state/federal laws, speak to a legal advisor.

Tip Management and DOL Penalties

While there have always been significant penalties for federal labor law violations, the New Rule makes assessing these penalties even more accessible for the DOL. The Civil Monetary Penalty (CMP) for violation of the FLSA is up to $1,100 per violation. Previously, before imposing a penalty, the Department of Labor had to find that the violation was “repeated or willful.” This helped them assess the penalties they chose to impose.

However, under the Final Rule, this is not the case. Violations against the ban on employers keeping employee tips, including as part of a tip pool, do not need to be seen as “repeated or willful.” In these cases, the Department of Labor can assess penalties at its discretion. Essentially, this means that they will most likely assess CMPs more often when managers, supervisors, or employees take all or a portion of employee tips violating the latest rules.

What can employers do?

Our advice to employers in this field is to create a written compliant policy on tip management within their organization. Once the policy has been established, offer training to staff so that they know and understand how the process works and how they will benefit. Ensure that managers are well aware of the latest state and federal rules around tips and tip pooling, and carry out regular checks to ensure the policies are being adhered to.

Overall, these new rules ensure that employees get to keep more of their hard-earned tips, and rightfully so. As an employer in the hospitality or restaurant industry, you know how hard your staff work to ensure a positive customer experience. Tip management is just one-factor affecting employee engagement and, in turn, employee turnover.

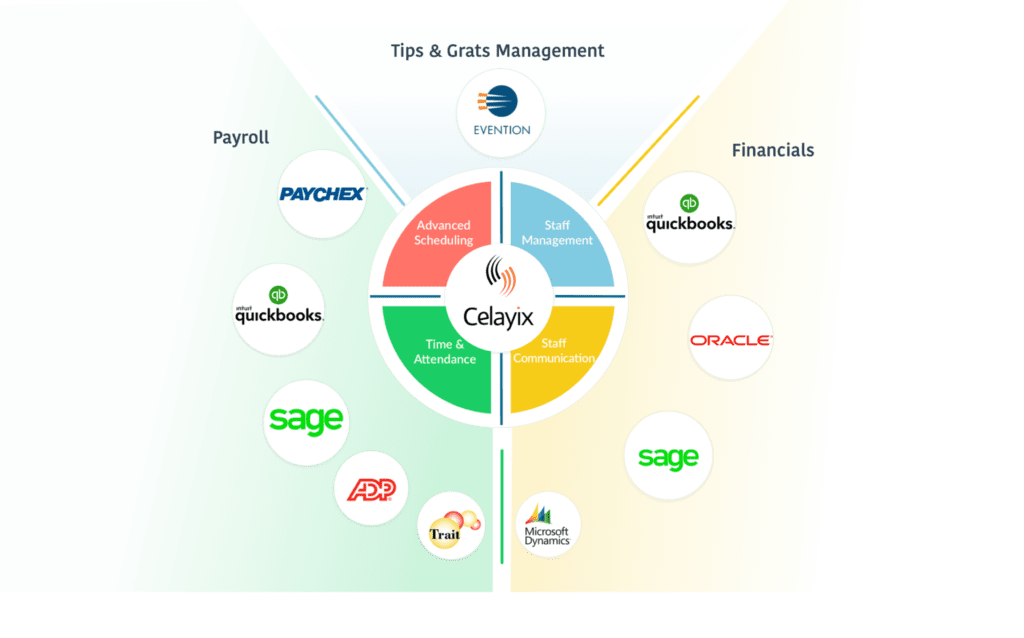

Evention: Your Tip-Management Partner

Hiring in the hospitality industry is more challenging now than ever, so ensuring your employees get the most from their tips is in your best interest in the long run. Celayix partners with Evention, a Tip & Gratuity Management system designed specifically for these industries. If you’d like to hear more about how Celayix and Evention can make your life easier, speak to a Software Advisor by contacting us here!