On-demand pay is a way of paying employees immediately after work. On-demand pay guarantees that employees get paid before the next scheduled payday. It allows employees to get either one day’s salary or the total of their earnings so far. According to EY research, 70 percent of workers today are paid monthly or every two weeks. On the other hand, 80% of workers want to adopt other solutions. These solutions would allow them to access previously earned money before the conventional payday. This blog will look at the purpose of On-Demand Pay while exploring the benefits of using it in your organization.

Why On-Demand Pay?

Many people live paycheck to paycheck. Studies show that 42% of full-time workers in the United States struggle to cover household bills on time each month. The worldwide health pandemic has only exacerbated the problem of financial instability, particularly among the most vulnerable. As a result, employees that are paid promptly may feel more financially secure. Subsequently, their loyalty to, and happiness with the firm increases. According to a new survey, Americans of all income levels would be more loyal to their employers if they could access their money as they earned it.

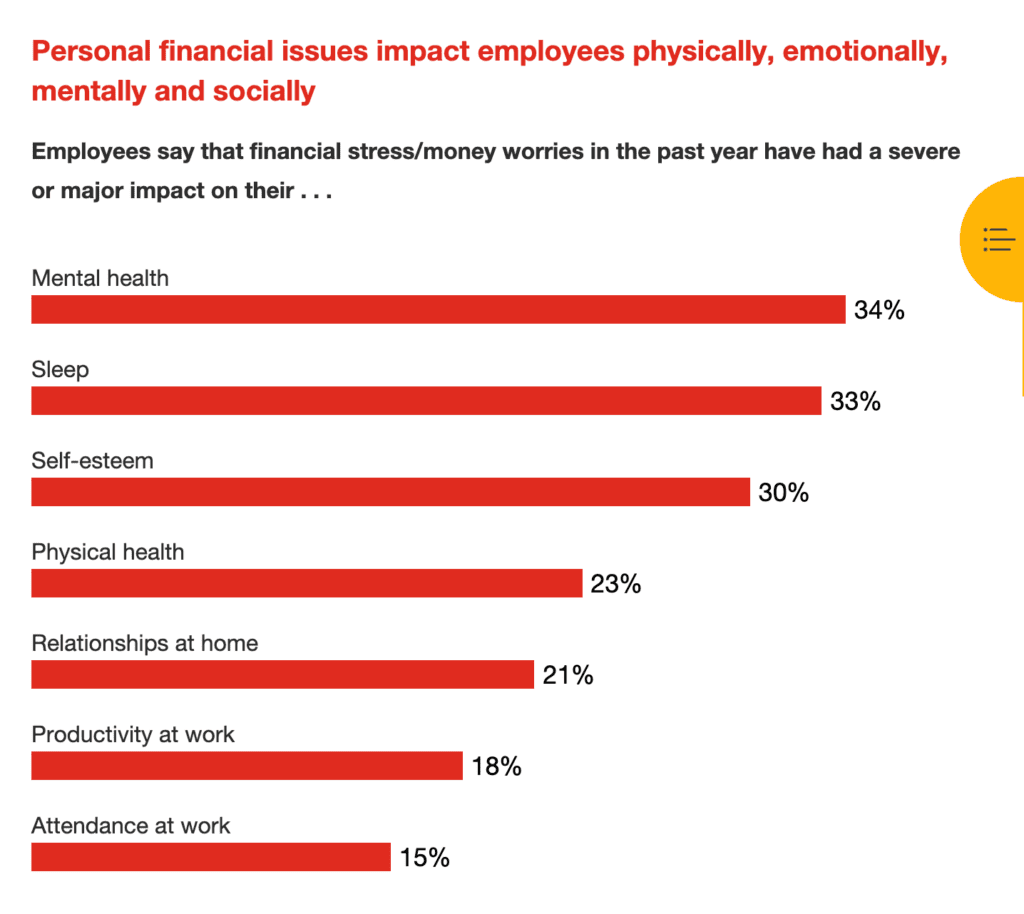

A survey conducted by PwC showed that the impacts of financial stress can run deep. 3000 US employees feel the pressure of meeting their day-to-day financial needs. Through On-Demand Pay, companies offer employees a different working environment where employees are remunerated almost immediately.

As per an article by Nasdaq, there are 3 primary reasons for shifting towards on-demand pay:

Financial control versus financial distress

Employees in financial distress have had few options for meeting obligations if they run out of money before payday. Consequently, many people value having more financial control through speedier access to pay.

Payday loans, which are frequently necessary for underserved and underbanked populations can have annual percentage rates of up to 300%, according to the Center for Responsible Lending. Credit cards can also charge more than 20% in interest and fees. Furthermore, many low-income workers were hit with billions in overdraft fees last year. When these factors are considered together, the conclusion is clear. In 2022, employees deserve the ability to access the money they have earned rather than experiencing unnecessary financial stress while waiting for a traditional payday.

Heightened focus on financial wellness

Employee turnover is higher when there is a lack of financial wellness and company flexibility. This is especially true among hourly and lower-wage workers. Furthermore, financially stressed individuals are twice as likely to quit positions. This results in increased hiring expenses for people leaders and, in many cases, lower employee morale. It should come as no surprise that financial well-being has been a higher priority for many organizations.

According to PwC’s recent employee financial wellness survey, nearly 75% of workers with increased financial stress would be attracted to employers who care more about their financial well-being. The same is true for 57% of workers who did not experience increased financial stress.

Fixing a payroll infrastructure built for the 1940s

Workplaces have evolved. The need to modernize the standard pay experience has developed alongside these seismic workplace changes. For everyone from gig workers to an elastic workforce and beyond. However, how employees are paid has not changed.

Today’s pay periods are based on ‘historical momentum’ rather than any deliberate choice. There is no reason that biweekly or monthly would work best for the individuals involved. In a recent examination of on-demand pay, the Consumer Financial Protection Bureau stated that the endurance of normal pay periods “appears to be mostly driven by efficiency problems with payroll processing and firms’ cash management.”

Employers have been obliged to establish fixed cycles and pay their employees in arrears. This means paying for work accomplished in a previous pay period rather than the current one. This is due to the use of old batch processing technologies. This long-standing norm financially disadvantages employees and, in today’s context, exacerbates the economic problems encountered by many Americans. However, with technological improvements, organizations may now design a holistic wellness strategy that includes access to on-demand compensation. This benefits both the employer and the employee.

As we emerge from a borderless, post-pandemic world, technology will play a vital role in breaking down old barriers in the workplace and facilitating the flexibility and immediacy that the future requires. To facilitate this new working environment, savvy employers will look to solutions such as on-demand pay — differentiating themselves, boosting their employer brand, and positioning their company for future success.

Benefits of On-Demand Pay

Creating Financial Equity For Employees

Whether an employee wants to invest earned wages or needs to pay for an urgent auto repair, having access to pay on-demand can help workers better manage their finances and get their money sooner. Expenses do not follow a two-week pattern and only around four out of ten Americans could afford a $1,000 unexpected expense.

With On-Demand Pay, employees get Faster payments. Employees do not have to wait until their next payday for money with on-demand payments. This flexibility allows employees to receive, save, and spend money on their own time. This helps employees get better financial security. If an employee receives unexpected bills or other urgent expenditures, on-demand pay can assist the individual in rapidly covering these expenses.

According to a Federal Reserve research, more than 35% of adults would be unable to cover a $400 emergency bill with cash or its equivalent. When an emergency arises, many workers turn to payday loans, credit cards, or other high-interest stop-gap choices, which often aggravate the situation. Employees can better retain financial stability in the face of unexpected expenses if they have access to a low-cost solution to address financial emergencies swiftly.

Reputable on-demand pay providers will frequently offer a comprehensive employee portal through which employees can rapidly access earned wages.

Financial Well-being can lead to physical well-being

Stress has long been recognized to cause serious health consequences. Unfortunately, money concerns are a major source of stress for employees. Employers can help their employees maintain a good work/life balance and become productive by reducing financial worries and stress.

Furthermore, giving employees more say over their remuneration might improve their general quality of life. Pay-on-demand services can help employees improve their mental health, and reduce distractions and work mishaps. It can also save medical costs associated with stress-related disorders.

Indirect benefits for the Employers

- Increased Productivity: Employees have more peace of mind about their finances. Financial wellness boosts productivity, reduces costs, and has a favorable influence on the bottom line.

- Competitive Advantage in Recruiting: On-demand compensation provides organizations with a competitive advantage in the battle for top personnel. Employees frequently choose on-demand pay over better salary.

- Retention of Employees: On-demand pay is an important motivator for employees to join and stay with a company. Furthermore, the cost of on-demand pay is small when compared to the expense of controlling staff turnover.

- Increased Options: Employees have more flexibility/choice in determining when and how they receive their compensation.

- Accessibility: Increased frequency of salary disbursement improves financial security by providing faster and more consistent access to funds.

Evaluating On-Demand Pay for your Organization

On-demand pay may not be appropriate for all businesses. For instance, in small businesses the cost of selecting and deploying a solution may outweigh the benefits. For others, it might be a low-cost recruitment tool that helps retain talent in today’s competitive labour market. According to research, 78 percent of U.S. workers believe free access to on-demand pay would boost their loyalty to an employer. Another 79 percent believe it would make them feel more valued at work. Consider the following factors when deciding whether on-demand compensation is appropriate for your workforce:

- Can you limit or restrict the amount staff can withdraw?

Because every organization is unique, you should choose a solution that best meets the needs of your employees and your business.

- What does it cost employees?

Some on-demand pay providers offer their services at no cost to the client, generating revenue through other means such as employer fees or interchange on debit cards through which payments are transferred. Other service providers may impose a fee for each transaction or “withdrawal”. In some circumstances, the employer and the customer will split the cost, or the employer will pay all of the expenses.

- Does it provide staff wellness training?

In a recent study of working Americans conducted by SHRM and Morgan Stanley, financial planning was ranked fourth, after retirement, safety insurance, and education perks. Some on-demand pay programmes provide employees with instructional information as a value-added perk.

- Does it assist employees in achieving financial success?

According to the findings of the research, consumers with household incomes of $100,000 or more would desire free access to on-demand pay in order to invest their earnings sooner than regular pay cycles allow. Understanding a provider’s roadmap is important for looking for tools like rewards programmes, budgeting, and investing.

Conclusion

Employees can now be paid on demand thanks to advances in technology. The money owed to employees (often known as their “pay balance”) is delivered straight to them on the day it is earned. On-demand pay is motivated by the desire to relieve employees of financial stress, resulting in happier, more productive, and better-engaged employees.

It is crucial to emphasize that On-Demand Pay solutions might be useful not only to low-income folks or those with limited financial resources. Access to earned income can give all employees significantly greater financial control by allowing them to better match income with expenses, allowing for better budgeting and improving their financial well-being.

The realization of On-Demand Pay’s full potential will be dependent on a number of circumstances, including an accommodating legislative environment, alignment with employer interests, and consumer uptake. What is evident is that, when compared to the various alternative financing choices, it provides a strong economic argument for businesses and considerably superior financial outcomes for employees.